Finding the home insurance best rates in Texas is essential for new homeowners navigating the complex landscape of insurance options. Texans typically spend hundreds to thousands of dollars annually on homeowners insurance premiums, a significant expense that often goes unconsidered during financial planning. This guide clarifies coverage types, rate influencers, and strategies for securing affordable policies, ensuring you can effectively navigate Texas’s insurance market while protecting your investment.

Toc

- 1. Understanding Texas Homeowners Insurance

- 2. Types of Homeowners Insurance Policies

- 3. Factors Affecting Your Home Insurance Rates

- 4. Strategies for Getting the Cheapest Home Insurance in Texas

- 5. Related articles 02:

- 6. Understanding Deductibles and Their Impact

- 7. Essential Tips for First-Time Homebuyers

- 8. Evaluating the Best and Worst Homeowners Insurance Companies

- 9. Conclusion

- 10. Related articles 01:

Understanding Texas Homeowners Insurance

Homeowners insurance is a crucial component of safeguarding your home and personal belongings. Understanding the nuances of homeowners insurance in Texas can help you secure the best rates while ensuring you have adequate coverage.

What is Homeowners Insurance?

Homeowners insurance is a type of property insurance that provides financial protection against certain types of damage to your home and personal property. It generally includes three main components:

- Dwelling Coverage: Protects the physical structure of your home.

- Personal Property Coverage: Safeguards your belongings.

- Liability Coverage: Covers legal claims against you if someone is injured on your property.

Importance of Adequate Coverage

Choosing the right coverage amount is crucial. Underinsuring your property may lead to significant financial losses in case of disasters like fires or storms. Conversely, overinsuring can result in unnecessarily high premiums. Evaluating the value of your home and personal possessions helps determine the appropriate coverage levels, which is vital when searching for the home insurance best rates in Texas.

Texas Department of Insurance

The Texas Department of Insurance (TDI) safeguards consumers and enforces fair business practices among insurance companies. Familiarizing yourself with TDI’s guidelines can help you navigate your options more effectively and understand your rights as a policyholder.

Mortgage Lender Requirements

If you are financing your home through a mortgage lender, they will typically require you to carry homeowners insurance. Lenders usually stipulate a minimum coverage amount that should equal or exceed the loan amount. Meeting these requirements while seeking the home insurance best rates is essential to maintain your mortgage agreement.

Types of Homeowners Insurance Policies

When searching for the best home insurance in Texas, understanding the different types of homeowners insurance policies available is crucial. Each policy type offers varying levels of coverage and protection.

HO-2 (Broad Form)

The HO-2 policy, also known as the Broad Form policy, provides coverage for specific risks, including fire, theft, and vandalism. While it offers essential protection, it has limitations regarding the perils it covers. This policy is suitable for homeowners looking for fundamental coverage without extensive costs.

Pros:

- Lower premiums compared to more comprehensive policies.

- Covers a range of named perils.

Cons:

- Limited coverage; excludes many perils.

- Not ideal for high-risk areas.

HO-3 (Special Form)

The HO-3 policy, or Special Form policy, is the most common type of homeowners insurance. It covers all perils unless specifically excluded, providing broader protection for your home and belongings. This policy is suitable for most homeowners seeking comprehensive coverage.

Pros:

- Extensive coverage for most risks.

- Suitable for homeowners in various risk categories.

Cons:

- Higher premiums than HO-2 policies.

- Still excludes certain perils like floods and earthquakes.

HO-5 (Comprehensive Form)

The HO-5 policy, also known as the Comprehensive Form, offers the most comprehensive coverage available. It includes open peril coverage for both the dwelling and personal property, meaning it covers nearly all risks except for specifically excluded events. This type of policy is ideal for homeowners who want the highest level of protection.

Pros:

- Maximum protection against various risks.

- Covers personal property on an open peril basis.

Cons:

- Higher cost than other policy types.

- May not be necessary for homes in low-risk areas.

Comparison Table

| Policy Type | Coverage Type | Pros | Cons |

|---|---|---|---|

| HO-2 | Named perils | Lower premiums, essential coverage | Limited coverage, not ideal for high-risk areas |

| HO-3 | Open perils (most) | Extensive coverage | Higher premiums, excludes floods/earthquakes |

| HO-5 | Open perils (all) | Maximum protection | Highest cost, may be unnecessary in low-risk areas |

Choosing the Right Policy

When selecting a homeowners insurance policy, consider your specific needs, risk factors, and budget. While comprehensive coverage may seem appealing, it’s not always necessary. A less comprehensive policy might be sufficient and more affordable for some homeowners. Assess factors like the value of your home, the likelihood of specific risks, and your financial capacity to absorb deductibles.

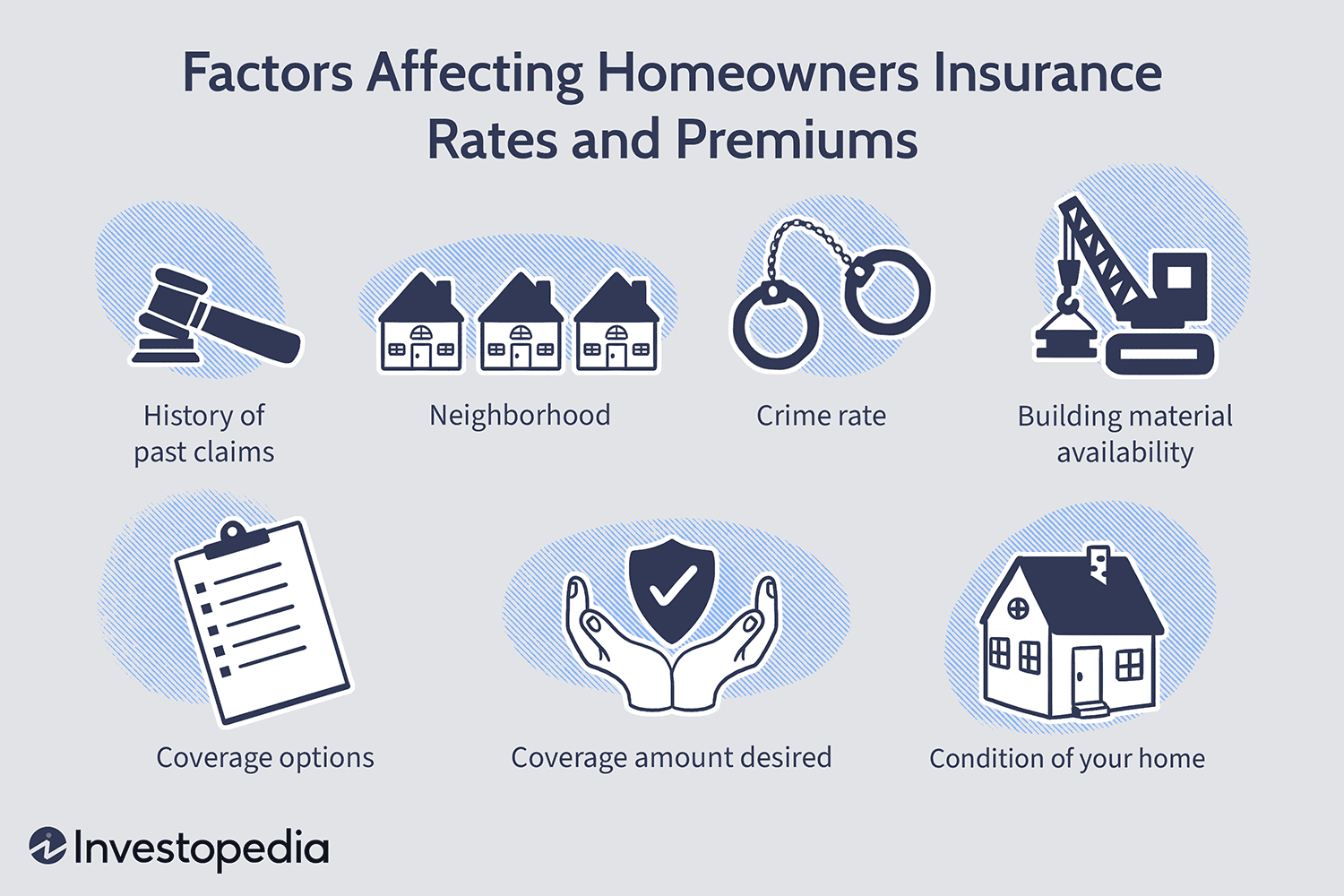

Factors Affecting Your Home Insurance Rates

Numerous factors influence home insurance rates in Texas. Understanding these can help you find the cheapest homeowners insurance while ensuring you have adequate coverage.

Home Value and Replacement Costs

The value of your home and its replacement cost significantly influence your homeowners insurance premiums. Insurance companies evaluate how much it would cost to rebuild your home in case of a total loss, which directly affects the rate you pay. To estimate replacement costs accurately, consider hiring a professional appraiser or using online calculators.

Climate Change and Its Impact

Climate change is a significant factor influencing insurance costs, particularly in Texas, which is vulnerable to hurricanes, wildfires, and flooding. Increased hurricane frequency and intensity, along with rising temperatures leading to droughts and wildfires, are driving up claims and, consequently, insurance premiums. For example, the National Oceanic and Atmospheric Administration (NOAA) reported a notable increase in the number of Category 4 and 5 hurricanes, which can dramatically affect insurance rates and availability.

Location and Its Impact

Where you live in Texas can also affect your home insurance rates. Areas prone to natural disasters, such as hurricanes or floods, may experience higher premiums. Additionally, neighborhoods with higher crime rates can lead to increased insurance costs. Understanding the risks associated with your specific location is essential when searching for the cheapest home insurance Texas offers.

Age and Condition of Your Home

Older homes often have higher insurance premiums due to outdated materials and systems that may pose risks. Insurers consider the age of your home’s roof, plumbing, and electrical systems when calculating rates. Regular maintenance and updates can help reduce premiums, so investing in home improvements can be a smart financial decision.

Safety Features and Discounts

Installing safety devices can significantly lower your home insurance premiums. Many insurers offer discounts for features like smoke detectors, burglar alarms, and fire suppression systems. When shopping for homeowners insurance, inquire about available discounts based on safety features to help you achieve the home insurance best rates.

Credit Score and Claims History

Your credit score plays a crucial role in determining your home insurance rates. Insurers view homeowners with good credit as lower risk, which translates to lower premiums. Additionally, your claims history can impact future rates. Multiple claims in a short period can lead to increased premiums, so it’s wise to maintain a low claim frequency.

The Role of Technology in Home Insurance

A growing trend in the homeowners insurance industry is the incorporation of technology to assess risk and offer discounts. Many companies now utilize telematics and smart home devices to monitor risk factors in real-time. For example, some insurers offer discounts for homeowners who install smart home technology like security cameras, smart smoke detectors, and water leak sensors. These devices help mitigate risks, allowing homeowners to save on premiums while enhancing their safety.

Strategies for Getting the Cheapest Home Insurance in Texas

![]()

Finding affordable home insurance requires strategic planning and comparison. Here are some effective strategies to help you secure the best rates.

Comparing Quotes from Various Insurers

One of the most effective ways to secure the cheapest homeowners insurance is to compare quotes from different insurance providers. Utilizing online comparison tools can streamline this process, allowing you to see multiple options side by side. Ensure that you are comparing policies with similar coverage levels and deductibles to make informed decisions.

Exploring Reputable Insurance Companies

Several well-known insurers operate in Texas, each offering different strengths and weaknesses. When looking for the best home insurance in Texas, consider companies that consistently receive high ratings for customer satisfaction and claims handling. Researching the reputations of these companies can lead you to reliable options. Resources like J.D. Power and AM Best provide insights into customer satisfaction and financial stability, helping you make informed choices.

Utilizing Independent Insurance Agents

Consider working with independent insurance agents who represent multiple insurance companies. Independent agents can provide a broader range of options than those offered by a single insurer. They can help you find the best policies that meet your specific needs and budget, as they have access to numerous carriers and can compare rates effectively.

Discounts and Savings Opportunities

Many insurance companies offer discounts for various reasons, including bundling policies, having a claims-free history, or being a senior homeowner. Understanding these discounts can help you save significantly on your premiums. Always ask insurers about available discounts when obtaining quotes. For example, if you are a senior, inquire about the cheapest homeowners insurance for seniors options.

The Texas FAIR Plan

For homeowners who find it challenging to obtain coverage through traditional insurers, the Texas FAIR Plan serves as a safety net. This plan provides limited coverage for one- and two-family homes, townhouses, and condominiums. It’s essential to explore this option if you’ve been denied coverage elsewhere. According to TDI, the FAIR Plan is often a viable option for around 5% of Texas homeowners seeking insurance. Understanding when and how to utilize the Texas FAIR Plan can provide peace of mind during challenging times.

1. https://laptoppanasonic.vn/archive/2796/

2. https://laptoppanasonic.vn/archive/2794/

3. https://laptoppanasonic.vn/archive/2798/

Using Online Comparison Tools

Many websites and tools can help you compare home insurance quotes quickly. These platforms allow you to enter your information and receive multiple quotes from various insurers, saving you time and helping you find the best rates without having to contact each company individually.

Understanding Deductibles and Their Impact

What is a Deductible?

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Generally, opting for a higher deductible lowers your premiums. However, it’s crucial to choose a deductible that you can comfortably afford in case of a claim.

Selecting the Right Deductible

When deciding on a deductible, consider your financial situation and risk tolerance. A higher deductible can lead to savings on monthly premiums, but if you need to file a claim, you must be prepared to pay that amount upfront. Balancing affordability with risk is key to making the right choice.

Impact of Deductibles on Claims

Understanding how deductibles affect claims is vital. A higher deductible reduces the insurance company’s payout, which lowers your premiums. However, if you need to make a claim, you must cover the deductible amount. Finding a suitable balance between premium costs and deductible amounts can help maximize your financial benefits.

Essential Tips for First-Time Homebuyers

Start Early in Your Search

Beginning your search for homeowners insurance early in the home-buying process can save you time and money. The sooner you start gathering quotes and comparing policies, the better prepared you’ll be to make an informed decision.

Shop Around for the Best Rates

As mentioned earlier, comparing quotes from multiple insurers is essential for finding the cheapest homeowners insurance. Don’t settle for the first quote you receive; take the time to explore various options to secure the best coverage for your needs.

Review Your Policy Thoroughly

Before signing on the dotted line, carefully review your policy documents. Ensure you understand the coverage limits, deductibles, and any exclusions. Asking questions about unclear terms can prevent surprises when you need to file a claim.

Seek Clarification on Coverage

When speaking with insurance agents, don’t hesitate to ask for clarification on coverage details. Understanding the nuances of your policy is vital for ensuring that you are adequately protected against potential risks.

Consider Additional Coverage Options

Depending on your location and specific needs, you may want to consider additional coverage options, such as flood insurance or extended replacement cost coverage. If your home is in a high-risk area, these policies can provide an extra layer of security.

Evaluating the Best and Worst Homeowners Insurance Companies

Identifying Top Companies

While shopping for homeowners insurance, knowing which companies consistently provide high-quality service is essential. Look for insurers with strong customer satisfaction ratings and positive reviews for claims handling. Companies that rank well on platforms such as J.D. Power and AM Best are often reliable choices. Additionally, consider customer reviews and testimonials to gauge the overall reputation of the insurers you are considering.

Recognizing Companies to Avoid

Conversely, it’s equally important to be aware of insurers with poor ratings or customer service complaints. These companies may pose risks in terms of claim denials or delays. Researching customer experiences can save you from potential frustrations in the future. A quick online search can reveal common issues faced by policyholders with certain companies, helping you make an informed choice.

Conclusion

Finding the home insurance best rates in Texas is a vital step for first-time homebuyers. By understanding the different types of homeowners insurance, factors affecting premiums, and tips for securing affordable coverage, you can make informed choices to protect your investment. Remember to compare quotes, review policy details, and explore discounts to maximize your savings while ensuring your home is adequately protected.

Start your search today to ensure you’re adequately protected against the unique risks associated with owning a home in Texas. Whether you are looking for the best home insurance in Texas or evaluating the best and worst homeowners insurance companies, taking the time to research and compare can lead to significant savings and peace of mind.

1. https://laptoppanasonic.vn/archive/2796/

2. https://laptoppanasonic.vn/archive/2794/

3. https://laptoppanasonic.vn/archive/2793/